Call to Action: Paying Our Shuumi Land Tax

In philanthropy, how do we steward resources back to the lands and communities that have experienced historical inequities?

While it will not undo centuries of harm, it is a first step toward repair. NCG recognizes that we must move beyond optical land acknowledgments into tangible action. What does it mean to move towards right relationships with Indigenous communities? We are figuring it out.

Under Dwayne’s leadership, we have named racial equity as the North Star in our vision and our partners have stepped up in our constellation to invest in this vision. We are grateful to the Stupski Foundation for investing $1 million in NCG to mobilize philanthropy toward racial equity. Of course, the work continues to cultivate resources to sustain NCG’s broader vision. As we reflect on that, we asked ourselves, how can WE as an institution best steward these resources in alignment with our racial equity journey?

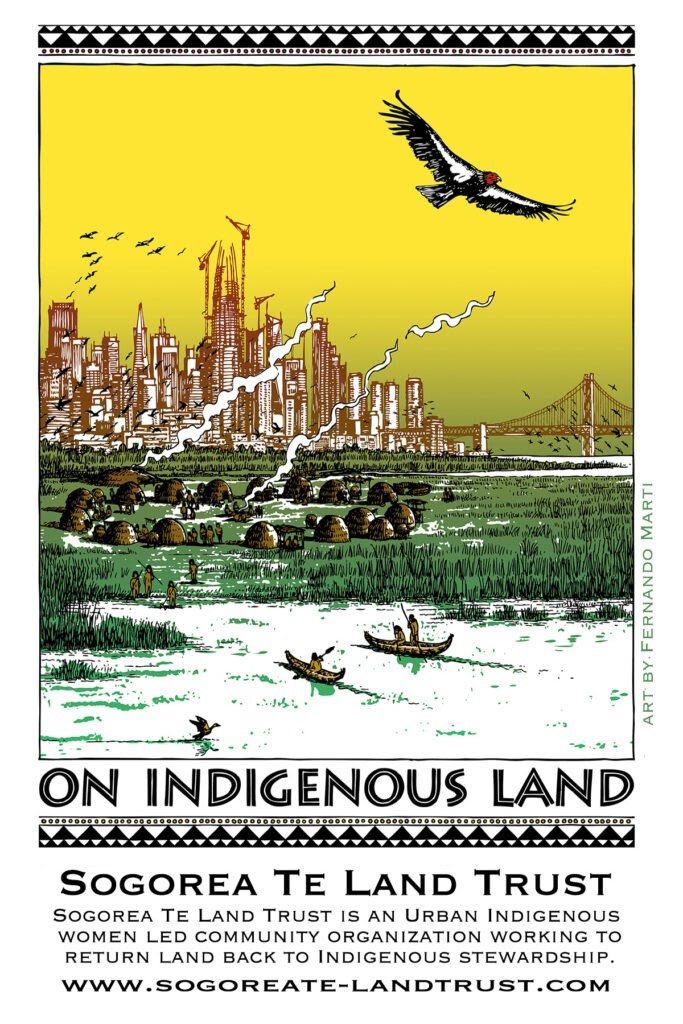

As an institution, we benefit from inhabiting the occupied lands of the Lisjan Ohlone people, land now known as the East Bay in the San Francisco Bay Area. In the spirit of repair, we are honored to share that we allocated a small percentage of the Stupski investment towards our institutional Shuumi Land tax, a voluntary annual contribution that organizations that operate in the Confederated Villages of Lisjan’s territory can make to support the critical work of the Sogorea Te’ Land Trust.

In 2023, we paid 1 percent of all membership revenue towards the three land taxes within our geography, including Sogorea Te’ Land Trust, Wiyot Tribe-Wiyot Honor Tax, and Association of Ramaytush Ohlone-Yunakin Land Tax. For future years, we continue to pay our institutional land and honor taxes. We invite you to also pay your institutional land tax and are happy to be a resource as you take the first step towards being in right relationship with Indigenous communities.